When every expert on this planet would saythat small investors are

better off when investing through Mutual Fund.

Can any one point out one mutual fund that

have not made enormous loss (more than 45%) in this falling

market. (Blame it on the market that everyone do).

This is not because we have fools managing thefund. BUT

This is because of the government's policy which ristrict mutual

funds to sell off their holding at will when the fund manager finds that

the market is going to crash.

While such restrictions are milder when itcomes to FII.

So this is a lose-lose situation when it comes to small inverstor who

thinks thatmutual funds are better and their money is safe in hands of

fund manager, While goodfund manager who picks good stock have

no right to sell and save "Small Investor" in such a crises.

What's your opinion. . . ?

My Technical Analysis Diary. . . . .Invest in stocks only after you have done your own Risk Management

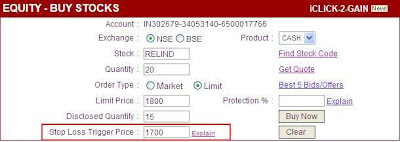

StopLoss order on ICICIDIRECT

In reply to the comment I am describing here how to put the

Stop Loss order on icicidirect.

Refer the screenshot and there is the "Stop Loss trigger price" as highlighted

bellow. This is the price when achieved a market order will be sent

and your position will be cleared booking the loss.

I have filled in this order as per the older discussion.

Update : I have added the sell stoploss order for Sharekhan screen too.

Stop Loss order on icicidirect.

Refer the screenshot and there is the "Stop Loss trigger price" as highlighted

bellow. This is the price when achieved a market order will be sent

and your position will be cleared booking the loss.

I have filled in this order as per the older discussion.

Update : I have added the sell stoploss order for Sharekhan screen too.

Stop Loss ka Funda . .

I was surprised when I found out that my good friend

who is in Market since 98 is not clear about Stop Loss. I also got the message

from this blog reader that he had lost good amount in this down turn

While I am "all in Cash" this time also since my Stop loss was 3800 on nifty:

Hence I am reproducing what I sent to my friend, on what is stop loss:

Quote:

Stop Loss is the "Funda"/"Policy" you need to implement

and not just order on icicidirect.com/sharekhan.com.

This is how it works:

StopLoss is the "Predecided" value at which the loss will be booked

if the price of share goes against your trade before creating the position.

ie If I buy Reliance at 1800 and keep stop loss at 1700 that means

I "Pre-Decide" that if the share price falls bellow 1700 it is not

going to rise hence sell reliance and book loss without averaging.

Now you can put such order in icicidirect but stoploss will continue

only for that day. While what this "Funda" means that you need to track

the prices and sell on the day Reliance price goes and closes bellow 1700.

While I use something called trailing stoploss. Here I keep moving

my stoploss upward (downward revision not allowed). So now assume

that Reliance share moved from 1800 to 1900 I move my StopLoss to 1800

and then if it moves to 2500 I move my StopLoss to 2400. Assume that

price now falls to 2380. I sell Reliance at 2380 <>http://learnthetrick.blogspot.com/2007/02/importance-of-stop-loss.html

:Unquote.

I have also kept some usefull links on the right side of this blog but people

tend to look at this blog only for "tips". I suggest all to read following http://yndesai.110mb.com/yndpages/doku.php?id=faq:newbie

Very few might have "LEARNED THE TRICK" alas !

who is in Market since 98 is not clear about Stop Loss. I also got the message

from this blog reader that he had lost good amount in this down turn

While I am "all in Cash" this time also since my Stop loss was 3800 on nifty:

Hence I am reproducing what I sent to my friend, on what is stop loss:

Quote:

Stop Loss is the "Funda"/"Policy" you need to implement

and not just order on icicidirect.com/sharekhan.com.

This is how it works:

StopLoss is the "Predecided" value at which the loss will be booked

if the price of share goes against your trade before creating the position.

ie If I buy Reliance at 1800 and keep stop loss at 1700 that means

I "Pre-Decide" that if the share price falls bellow 1700 it is not

going to rise hence sell reliance and book loss without averaging.

Now you can put such order in icicidirect but stoploss will continue

only for that day. While what this "Funda" means that you need to track

the prices and sell on the day Reliance price goes and closes bellow 1700.

While I use something called trailing stoploss. Here I keep moving

my stoploss upward (downward revision not allowed). So now assume

that Reliance share moved from 1800 to 1900 I move my StopLoss to 1800

and then if it moves to 2500 I move my StopLoss to 2400. Assume that

price now falls to 2380. I sell Reliance at 2380 <>http://learnthetrick.blogspot.com/2007/02/importance-of-stop-loss.html

:Unquote.

I have also kept some usefull links on the right side of this blog but people

tend to look at this blog only for "tips". I suggest all to read following http://yndesai.110mb.com/yndpages/doku.php?id=faq:newbie

Very few might have "LEARNED THE TRICK" alas !

All stop loss hits All in Cash

All stop loss hits All in Cash you should be if you had stop losses.

So looking for clues I turn to Fibbonacci

In Nifty chart there are 2 scenario emerging.

One is the bull rally that ended on 8 Jan 2008 (6288 High) started

on 25 april 2003 when Nifty was 924 (I feel this is more convincing to ME)

and

Second thought is that rally started on 17 May 2004 when Nifty was 1338.

Now with 924 as start of rally we get following support levels can be arrived at

Delta = 6288 - 924 = 5364

High - 0.618 Delta = 6288 - (0.618 x 5364) = 2973 (Bot most level)

High - 0.5 Delta = 6288 - (0.5 x 5364) = 3606 (Mid level)

High - 0.382 Delta = 6288 - (0.328 x 5364) = 4239 (Top level)

While considering 1388 as start of rally we get

3260 (Bot most level)

3838 (Mid level)

4416 (Top level)

So looking for clues I turn to Fibbonacci

In Nifty chart there are 2 scenario emerging.

One is the bull rally that ended on 8 Jan 2008 (6288 High) started

on 25 april 2003 when Nifty was 924 (I feel this is more convincing to ME)

and

Second thought is that rally started on 17 May 2004 when Nifty was 1338.

Now with 924 as start of rally we get following support levels can be arrived at

Delta = 6288 - 924 = 5364

High - 0.618 Delta = 6288 - (0.618 x 5364) = 2973 (Bot most level)

High - 0.5 Delta = 6288 - (0.5 x 5364) = 3606 (Mid level)

High - 0.382 Delta = 6288 - (0.328 x 5364) = 4239 (Top level)

While considering 1388 as start of rally we get

3260 (Bot most level)

3838 (Mid level)

4416 (Top level)

Paradox, up Up and Away symptom . . !

I got surprised at the sight of this, There are more advances than declines and

index has fallen on friday. . ! While 3800 is intact on Nifty.

What does this mean, Monday market is going to be up and many be the indication

of up up and away symptom.

Subscribe to:

Comments (Atom)