In reply to the comment I am describing here how to put the

Stop Loss order on icicidirect.

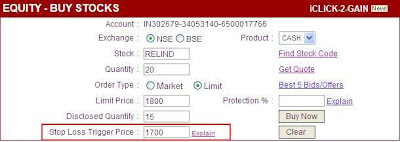

Refer the screenshot and there is the "Stop Loss trigger price" as highlighted

bellow. This is the price when achieved a market order will be sent

and your position will be cleared booking the loss.

I have filled in this order as per the older discussion.

Update : I have added the sell stoploss order for Sharekhan screen too.

Stop Loss order on icicidirect.

Refer the screenshot and there is the "Stop Loss trigger price" as highlighted

bellow. This is the price when achieved a market order will be sent

and your position will be cleared booking the loss.

I have filled in this order as per the older discussion.

Update : I have added the sell stoploss order for Sharekhan screen too.

12 comments:

Dear Yagnesh.

Thx.Could see ur reply 2day only.

This case is one wherein u r putting a buy(limit buy ) order and once that is converted to actual buy the SLTP gets ready and if at all the price touches 1700, an order to sell at market price is activated to minimise to the extent possible ur loss.

Now, suppose somebody has already bought a share of RELIND a year back and observing that price has reached 1800 as close price of today.If he wants to sell it if the price touches 1700 tomorrow.ie sort of a trailing stoploss.

Is there any way of doing this through ICICI system.This order should be placed before opening of market as he cannot see the prices all the time due to his style of work.

A revert should be appreciated..

thx n advance

No from next day you will not be able to put a SL order.

Dear Yagnesh,

A regular watch on the price then the only solution???

thx

Thanks for the screenshot. But during market hours when I place the order (Just use your example R. Industries) What I am getting (message) is Stop loss price can’t be less than the Limit Price ....

What is disclosed quantity?? Could you please explain(I did left empty when I tried to place stop loss)

I don’t know what i am missing..Please let me know

First of all

Stop loss order in icicidirect have to be placed along

with the order which open your position.

ie at the time you buy stock then only you can keep stoploss sell

order.

If you make a buy order RIL (Current Market price = 1150)

qty = number of share you want to buy (Assume 100)

Limit price is price at which you want to buy = 1150 (No need if you

select market as order type)

Disclose quty = Some qty less than the quantity you want to buy. (50)

stoploss triger price= price at which stop loss order will get generated

less then your limit price and current market price. (let us say 1098

considering 1100 as psycological level)

With this order you will generate a long position and also a stoploss.

But the catch here is that this stoploss will be valid for the day you

bought the share and not for next day.

As KPR said that it gives the below message when we put like this

"Stop loss price can’t be less than the Limit Price ...." to do so is it neccessary to put Disclosed Quantity or we are doing something wrong . Please suggest...

My screen-shot shows the stoploss order for the buy order. Hence if you are trying the same with the sell order the price values have to be in following order.

For sell order

Current price > stoploss trigger price > Limit price.

Do not save what is left after SPENDING but spend what is left after SAVING.

Capitalstars leading advisory firm from last 15 years

Capitalstars pricing go for it !

The following time I learn a blog, I hope that it doesnt disappoint me as a lot as this one. I imply, I know it was my option to read, but I actually thought youd have one thing fascinating to say. All I hear is a bunch of whining about something that you might fix in the event you werent too busy searching for attention. free online casino slots

How to set stop.loss for option call after one day of share bought

Post a Comment